Understanding the Four Major Re-Pledge Agreements: Who is the Ultimate Winner?

Author: David C, Bankless; Compiled by: Whitewater, Golden Finance

EigenLayer’s recent EIGEN “pledge drop” was not the ecstatic moment for the industry that many expected.

While some novel design features earned praise, the overall sentiment seemed to be skewed toward the negative. EIGEN’s initial non-transferability, VC-centric token distribution, and lack of direct rewards for the key DeFi protocols that drive heavy participation in EigenLayer left many feeling marginalized.

While alternative restaking protocols have been in development for some time, this mixed reaction to the EigenLayer token drop has shifted some interest to other players, competitors on Ethereum, and on protocols that pave the way for other networks.

Projects like BounceBit, Symbiotic, Solayer, and Karak Network are some of the more notable examples of popular protocols that have taken their own approach to re-staking, whether by diversifying the assets that can be deposited or the assets they come from ecosystem.

In this article, we will explore the key features of these new protocols to determine what they can bring to the restaking market.

Karak Network

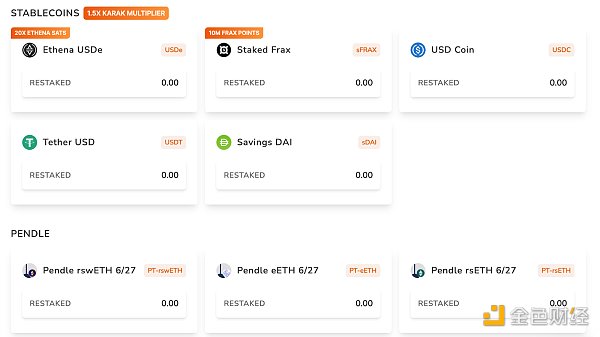

Karak is a universal re-pledge layer that is already compatible with a variety of assets, including stablecoins such as LST, USDe and sDAI, as well as Pendle PT positions.

Backed by funds such as Coinbase Ventures, Pantera Capital and DCG, Karak supports assets on multiple chains such as Mantle and Arbitrum, expanding the market share from which it can attract capital. Additionally, Karak's approach leverages two additional mechanisms to stand out:

< strong>Universal Security:By standardizing capital requirements, Karak makes it easier for new protocols to use a secure network of trust with its protocol from the start. This common approach simplifies the developer onboarding process while also enhancing network intercompatibility.

Validator Marketplace: Karak creates a marketplace where developers can incentivize validators to use re-staking assets to secure their services. This eliminates their need to create new, high-inflation tokens, making rewards more consistent while reducing costs, making Karak more efficient and scalable.

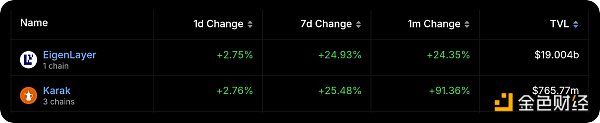

While Karak is still nowhere near the size of EigenLayer, it has grown nearly 4x in the past month, whether due to disappointment with EigenLayer's decline or the market simply looking for more returns.

Regardless, Karak’s broad asset support (it even already supports DeFi positions) makes it stand out from EigenLayer. Whether it can overcome the capital moat EigenLayer has established is another question entirely.

Symbiotic

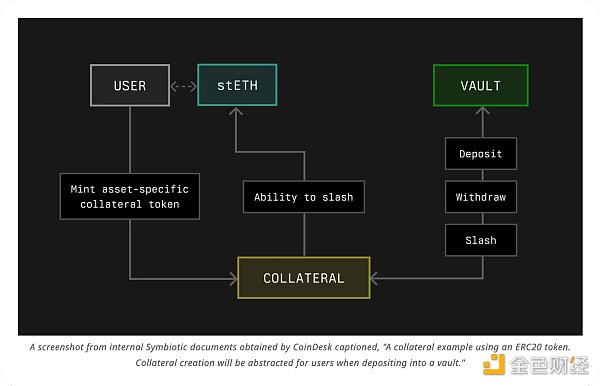

Funded by Lido co-founders and venture capital firm Paradigm, Symbiotic aims to compete directly with EigenLayer by allowing any ERC-20 token to be restaking on Ethereum.

Not much is currently known about Symbiotic, other than that the protocol will accept any ERC-20 token, which greatly expands the total addressable market for restaking and enhances its widespread integration in DeFi potential.

It doesn’t stop with ERC-20, though. Symbiotic said it will also accept other forms of collateral, including on-chain assets such as ETH validator withdrawal certificates and LP positions, regardless of which blockchain they are on. In other words, re-pledge your PEPE/MOG Uni V3 position.

A key to Symbiotic The competitive advantage may come from its alignment with Lido's founders. Recently, Lido announced their Lido Alliance framework, which focuses on finding ways to make stETH a re-staking hub. Given Lido’s position as Ethereum’s leading protocol, stETH’s primary position as a core DeFi component, and the founders’ investment in Symbiotic, this could provide a solid foundation for the project’s launch and integration.

Symbiotic, which is reportedly set to launch by the end of this year, has the potential to accept a variety of ERC-20 tokens and other forms of collateral, which could make it a formidable competitor to EigenLayer.

Solayer

The recently soft-launched Solana re-staking provider Solayer intends to bring an application chain network to the popular L1 to extend economic security and execution capabilities.

We are already starting to see some early development of Solana L2; Solayer can extend this need, leveraging Solana's architecture to provide application developers with a higher degree of consensus and block space customization.

From a supply side, Solayer is definitely in demand, with deposits of SOL and LST hitting the $20 million cap in just 45 minutes. While Solayer may have had a strong (soft) launch, the game is certainly not over yet. It is competing with Cambrian, Picasso and potentially Jito, which has long been rumored to be building a restaking game. Given Jito's place in the ecosystem, Solayer may have its work cut out for it.

BounceBit

BounceBit brings re-pledge functionality to Bitcoin, allowing BTC holders to earn revenue while expanding opportunities for new applications on the network.

The protocol works by allowing users to deposit Bitcoin from various networks (native Bitcoin, BTCB on BNBChain and WBTC) into regulated custody on Mainnet Digital and Ceffu, where what happens Two things.

Bitcoins in regulated custody are locked, allowing users to mint equivalent mirror tokens BBTC on the BounceBit chain and delegate them to the node operator and receive stBBTC as a voucher. This stBBTC can then be re-staking to Shared Security Clients (SSC) — BounceBit’s AVS — such as bridges, oracles, and sidechains to earn more staking rewards or be used for DeFi yields.

Meanwhile, the original Bitcoins in custody continue to earn through arbitrage, providing ongoing income.

Since BounceBit is also EVM compatible, it can bring existing DeFi liquidity into the Bitcoin ecosystem, help accelerate the adoption of DeFi applications in the network, and expand Its use cases and practicality.

In summary, BounceBit’s approach allows Bitcoin holders to maximize their earning potential through regulated arbitrage and re-hypothecation opportunities, while leveraging this capital security to expand the potential for Bitcoin possibility.

Who is the winner?

Recent dissatisfaction with EigenLayer’s EIGEN token dump opened the door for competing restaking protocols to come on board and attract interest from dissatisfied users.

BounceBit, Symbiotic, Solayer and Karak all bring new perspectives to the market, expanding and enhancing the overall re-hypothecation landscape.

No matter which projects gain early traction in their respective networking spaces, one thing is for sure - EigenLayer has set some pretty big expectations for the rehyping landscape, which is what many investors and builders potential rewards that investors desire.

Live Updates

- Jun 25, 2024 6:30 pm日 메타플래닛, 전략적 비트코인 관리를 강화하기 위해 영국령 버진 아일랜드에 완전 자회사 설립일본 상장사 메타플래닛은 전략적 비트코인 관리를 강화하기 위해 영국령 버진 아일랜드에 완전 자회사 설립한다고 전했다. 앞서 24일 메타플래닛은 10억 엔(약 87억원) 상당 채권을 발행하여 비트코인을 추가 매입할 계획이 이사회에서 승인됐다고 전한 바 있다. 메타플래닛은 마이크로스트레티지를 벤치마킹해 비트코인을 주요 자산으로 편입한다고 발표한 바 있다. 메타플래닛은 현재 약 141 BTC를 보유하고 있다. 번스타인: 이더리움 현물 ETF는 비트코인에 ... source: https://coincode.kr/21618

- Jun 25, 2024 6:28 pmUS Spot Bitcoin ETFs See 7th Consecutive Day of Outflows StreakCoinspeaker US Spot Bitcoin ETFs See 7th Consecutive Day of Outflows Streak Bitcoin's recent price drop to 3.34% triggers major outflows from leading Bitcoin ETFs, with Grayscale's GBTC fund losing $90 million. US Spot Bitcoin ETFs See 7th Consecutive Day of Outflows Streak source: https://www.coinspeaker.com/bitcoin-etfs-see-174m-outflows/

- Jun 25, 2024 6:28 pm번스타인: 이더리움 현물 ETF는 비트코인에 비해 수요는 더 낮을 수 있다이더리움 현물 ETF가 거래가 허용되면 비트코인 ETF와 비슷한 수요원을 가질 가능성이 있지만 그 규모는 더 작을 것이라고 증권사 번스타인이 월요일에 발표된 연구 노트에서 언급했다고 코인데스크가 보도했다. 애널리스트 고탐 추가니와 마히카 사프라는 보고서에서 이더리움 현물 ETF의 전환은 이더리움 스테이킹 기능이 없기 때문에 과도할 것으로 예상되지 않는다고 강조했다. 그러나 이들은 베이시스 거래가 점진적으로 매수자를 끌어들여 ETF 시장의 ... source: https://coincode.kr/21616

- Jun 25, 2024 6:25 pmPolkadot’s Community Proposal Eyes For Stablecoin DominanceThe Polkadot community wants to establish the blockchain network as a leader in stablecoin payments with a new proposal to boost adoption. The proposal seeks to reduce the minimum balance for Tether’s USDT and Circle’s USDC on the Polkadot Asset Hub to $0.01 from $0.07. The move is expected to drastically boost Polkadot’s attractiveness to … source: https://coinpedia.org/crypto-live-news/polkadots-community-proposal-eyes-for-stablecoin-dominance/

- Jun 25, 2024 6:24 pmSBI VCトレード、「法人向け期末時価評価課税の適用除外サービス」でステーキング手数料を割引「法人向け期末時価評価課税の適用除外サービス」でステーキング手数料割引 国内暗号資産(仮想通貨)取引所SBI VCトレードが、同社が6月4日より提出開始した「法人向け期末時価評価課税の適用除外サービス」の利用ユーザーを対 […] source: https://www.neweconomy.jp/posts/399046

- Jun 25, 2024 6:24 pmBitcoin ETFs Lost $174 Million After Confirmation of Mt. Gox RepaymentsIn the past five trading sessions, Bitcoin ETFs have seen net outflows of $714 million, according to data analytics platform SoSovalue. source: https://decrypt.co/236855/bitcoin-etfs-lost-174-million-mt-gox-repayments

- Jun 25, 2024 6:24 pmInstitutional Interest Dropping With Bitcoin ETFs Significant OutflowsOn Monday, the total outflows across all nine Bitcoin ETFs were $170 million in outflows with none of the ETFs recording any kind of inflows. The total outflows from spot Bitcoin ETFs have exceeded $1 billion in the last 10 days. Grayscale’s GBTC recorded the most outflows at $90.4 million. Fidelity’s FBTC followed with $35 … source: https://coinpedia.org/crypto-live-news/institutional-interest-dropping-with-bitcoin-etfs-significant-outflows/

- Jun 25, 2024 6:22 pmBlast Ecosystem Token Issuance Protocol ZAP Completes Airdrop of 35,000 Blast Gold PointsBlast Ecosystem Token Issuance Protocol ZAP published a post on the X platform stating that it has completed the distribution of 35,000 Blast Gold airdrops in Chapter 1 and Chapter 2, of which 20,000 Blast Gold was distributed to treasury holders and another 15,000 Blast Gold was distributed to ZAP users, including ZAP platform treasury holders. Blast Points will also be distributed in the next few hours before Blast TGE. In addition, ZAP Blast Gigadrops airdrop project rewards are also being distributed, and more than 20 projects participating in the ZAP Blast Gigadrops airdrop are independently distributing their rewards. ZAP users will receive multiple airdrop rewards at different times.

- Jun 25, 2024 6:20 pmJapanese listed company Metaplanet establishes a wholly-owned subsidiary to strengthen BTC asset managementJapanese listed company Metaplanet announced on X platform that it has established a wholly-owned subsidiary in the British Virgin Islands to strengthen the strategic management of BTC assets. Previously, Metaplanet's directors had approved a plan to purchase Bitcoin worth approximately $6.25 million (1 billion yen).

- Jun 25, 2024 6:00 pmMicroStrategy’s Saylor: Bitcoin Community Expects 50% Yearly GrowthMichael Saylor, the Chairman of MicroStrategy and a prominent Bitcoin advocate, recently polled the crypto community on their expectations for Bitcoin’s growth over the next decade. The results reveal a predominantly bullish sentiment, with nearly half of respondents predicting an annual appreciation of over 40%. On June 24, Saylor shared an X (formerly Twitter) post, […] source: https://coinedition.com/microstrategys-saylor-bitcoin-community-expects-50-yearly-growth/