Understanding LayerZero (ZRO) Token Economics in One Article

Source: LayerZero Foundation; Compiled by Tao Zhu, Golden Finance

ZRO is the native asset of the LayerZero protocol. Claims will open at 11:00 AM (UTC) on June 20. Click here to view eligibility.

LayerZero is a full-chain interoperability protocol that supports censorship-resistant messaging and permissionless development through immutable smart contracts called Endpoints.

The protocol exists forever. Anyone can use it. No one can tamper with the data packets it moves between chains.

Applying these principles to a production version is challenging, but the results speak for themselves. Since the release of V1 in 2022 and V2 in 2024, hundreds of developers have built applications and thousands of users have interacted with the protocol, resulting in over 200 applications sending over 130 million messages and $50 billion in transaction volume across 70+ blockchains.

The launch of ZRO marks a critical step for the protocol: making it publicly owned, immutable infrastructure.

This article takes a deep dive into ZRO, including token economics, token mechanics, and eligibility.

Token Economics

Supply

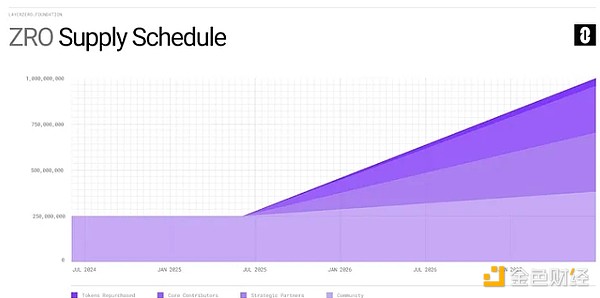

The ZRO supply is fixed at 1 billion tokens.

The distribution breakdown is as follows:

38.3% is allocated to the LayerZero community, including users, developers and community members;

32.2% is allocated to strategic partners, with an unlocking period of 3 years, including investors and consultants;

25.5% is allocated to core contributors, with an unlocking period of 3 years, including existing and future team members;

4.0% token repurchase, committed to distribution to the community.

Community Allocation - 383,000,000 ZRO

LayerZero's success is primarily due to developers building flagship crypto applications and users actively interacting with the protocol. These early members have made significant contributions and are well suited to become future stewards of LayerZero.

The community token allocation is designed to reward early, current, and future persistent developers and users of LayerZero while growing the LayerZero ecosystem.

The 38.3% “383,000,000” ZRO community allocation is broken down into the following time-based subcategories:

Retroactive Program:Eligible participants can claim 8.5% of the ZRO supply on June 20th. (More on eligibility later.)

Future Program:15.3% of the ZRO supply will be reserved for direct distribution to users, protocols, infrastructure builders, and community members via methods such as snapshots and RFPs. At launch, 11.5% of the ZRO supply will be unlocked from this pool, with distribution beginning with a new Discord community program that will use 5,000,000 ZRO.

Ecosystem and Growth:14.5% of the ZRO supply will be managed by the LayerZero Foundation. At launch, 5% of the ZRO supply will be unlocked from this pool for ecosystem growth, grant programs, and liquidity provisioning.

Strategic Partners - 322,000,000 ZRO

Strategic partners (including investors and advisors) are subject to a three-year lockup period, with one year of full lockup followed by two years of monthly unlocks.

Core Contributors - 255,000,000 ZRO

Core contributors, including current and future LayerZero Labs employees, are subject to a three-year lockup period, with one year of lockup followed by two years of monthly unlocks.

Token Buyback — 40,000,000 ZRO

4.0% of the ZRO supply has been bought back by LayerZero Labs and committed to the community pool.

Token Mechanics

ZRO holders will always control the accumulation of protocol fees.

The immutable voting contract executes a public on-chain referendum every six months, allowing ZRO holders to vote to activate or deactivate the protocol's fee switch.

The LayerZero protocol may charge a fee equal to the total cost of cross-chain message verification and execution. For example, if the DVN and executor configuration chosen by the application charges $0.01 for transactions between Arbitrum and Optimism, LayerZero may also charge a fee of $0.01.

If the fee switch is activated via governance, the referendum treasury contract collects and destroys the fee on the local chain. This mechanism is similar to EIP-1559 and effectively distributes fees to ZRO holders.

ZRO voting is simple: autonomous, on-chain, and immutable — enabling holders to turn the protocol’s fee switch on or off simply by signaling from the chain they hold ZRO.

Eligibility Requirements

LayerZero is one of the most widely used and most rewarded protocols ever: nearly 6 million unique wallet addresses have interacted with the protocol, and developers have deployed over 54,000 OApp contracts. This makes the initial token distribution difficult to get right.

While all transaction volume contributes to the protocol, it is imperative to ensure that long-term users are rewarded and maximally aligned with the protocol. Long-term users are defined as those who are most likely to continue using the protocol or repeat past actions in the future. Identifying and aligning these users requires implementing multiple processes prior to claiming. This includes Sybil filtering, protocol RFPs, and eligibility criteria.

The main problem with a “perfect” distribution is the gap between expectations and reality, which often leads to participant dissatisfaction. A large number of users interacted with LayerZero, with varying levels of activity. For example, 957,640 users made more than 50 transactions, 227,410 users made more than 100 transactions, and 1,075,590 users interacted with more than 15 chains. Additionally, LayerZero approved 211 protocol RFPs. Each protocol has unique distribution needs, so a one-size-fits-all distribution approach is not feasible.

Balancing all of these requirements at the scale of LayerZero's network is extremely challenging. While the ZRO distribution is not perfect, we believe it is right: rewarding long-term users in a way that maximizes user alignment with the LayerZero protocol.

The following outlines the qualification process for our first ZRO token distribution event.

Sybil Filtering

In the first phase, Sybil users have 14 days to self-report and receive 15% of their intended allocation. After this period, any Sybil users who did not report and were identified in the initial Sybil reports conducted by the LayerZero Foundation, Chaos Labs, and Nansen will not receive any rewards. In the second phase, bounty hunters can report Sybil activity and receive a 10% reward of the expected allocation of the identified addresses. After the bounty hunt ended, Chaos Labs and Nansen continued to work with the LayerZero Foundation to further filter out Sybil from the token allocation.

Through bounty hunting, self-reporting, and collaboration with Nansen and Chaos Labs, approximately 10,000,000 ZRO (approximately 1% of the total supply) were exempted from allocation to Sybil addresses.

Request for Proposal (RFP)

The protocol RFP is for projects that have deployed an OApp, OFT, or ONFT contract on mainnet prior to snapshot #1. This process allows teams to allocate their ZRO allocation to their respective communities in the most value-added manner.

Overall, 230 unique proposals were submitted, each outlining their end-user and developer allocation methods. Ultimately, 211 proposals were approved, receiving a total of 3% of the total ZRO supply to be allocated as they see fit.

Criteria

Final eligibility is based on a number of factors from both the Protocol RFP and LayerZero Core distribution sections.

Protocol RFP (3%)

Wallets listed in the approved Protocol RFP submissions are eligible, with a minimum ZRO allocation of 5 ZRO and a maximum of 10,000 ZRO. Any remaining allocations will be returned to their respective RFP groups.

Specific protocol allocations are determined based on several factors, including the number of messages sent before and after the snapshot, the number of days since the first message was sent on LayerZero, and the application category (OApp, OFT, ONFT). The developer allocation is targeting a 90/10 split, with a maximum of 100,000 ZRO per development team, with any excess ZRO being distributed to other developers.

Core (5.5%)

The LayerZero Core portion of the allocation is designed to retroactively reward users for their activity on the protocol. Allocations are based on protocol fees paid. All users who transacted prior to the snapshot are eligible, with a minimum allocation of 25 ZRO and a maximum allocation of 5,000 ZRO. Any amounts above these limits are reallocated within the LayerZero Core group.

The specific criteria are as follows:

Transactions below $1.00 and worthless NFT transactions (very low market value) are weighted down by 80% to prioritize true participation.

Multipliers are provided for early and post-snapshot users to recognize continued participation in the protocol.

Checker

You can find the official checker to see if your address is eligible here!

Summary

The ZRO distribution process is designed to be fair and transparent while supporting contributors and future growth.

Thank you to the developers, users, and community members who have contributed to the protocol to date.

Next steps: claim your ZRO on June 20th at 11:00 AM UTC.

More news about "chaos labs"

- May 07, 2024 1:06 pmChaos Labs proposes lowering the liquidation threshold on Aave V2 EthereumChaos Labs published the ARFC case on the Aave governance forum, proposing to lower the liquidation threshold on Aave V2 Ethereum.

- May 07, 2024 8:44 amLayerZero Labs To Release Witch Detection Report In Collaboration With Chaos Labs And NansenAccording to Foresight News, LayerZero Labs has announced its ongoing collaboration with Chaos Labs and Nansen to compile a witch detection report. The report will take into account the total weighted transactions of each user across all LayerZero applications. The aim is to align the Token Generation Event (TGE) with developers and long-term users. The report will be released after the self-reporting deadline for witches. In addition, the company has received requests from users about false reports of witch addresses. In response, the website will start offering an 'Unreport Witch' option from 12:00 Pacific Standard Time on May 7. This option will remain active until the self-reporting ends on May 18.

- Feb 01, 2024 11:27 pmdYdX: Cooperating with Chaos Labs to launch the dYdX Chain second quarter incentive plandYdX published a document on the X platform announcing its cooperation with Chaos Labs to launch the dYdX Chain second season incentive plan.

- Feb 01, 2024 11:18 pmDYdX Collaborates with Chaos Labs for Season 2 Incentive ProgramAccording to Foresight News, dYdX has announced a collaboration with Chaos Labs to launch the second season of the dYdX Chain incentive program. The partnership aims to further develop and promote the dYdX Chain, enhancing its features and capabilities.

- Jan 19, 2024 2:08 pmChaos Labs offers to assist Radiant in optimizing its market interest rate curveChaos Labs proposes a strategic cooperation with multi-chain lending protocol Radiant Capital, aiming to optimize the interest rate curve in the Radiant protocol market and promote decentralization. The Radiant Capital community is conducting a Snapshot vote on the proposal, with the deadline for voting being January 21st.

- Jan 19, 2024 8:18 amChaos Labs Proposes Strategic Partnership With Multi-Chain Lending Protocol Radiant CapitalAccording to Foresight News, Chaos Labs has proposed a strategic partnership with multi-chain lending protocol Radiant Capital. The collaboration aims to optimize the interest rate curve within the Radiant protocol market and promote decentralization. The voting deadline for this proposal is January 21.

- Dec 05, 2023 1:01 pmChaos Labs launches dYdX Chain analytics and risk monitoring portalOn-chain risk analysis platform Chaos Labs launches dYdX Chain analysis and risk monitoring portal. The portal offers dynamic leaderboards and also provides in-depth insights and risk assessment capabilities, as well as real-time tracking and visibility into launch incentive programs.

- Dec 05, 2023 12:12 pmChaos Labs Launches dYdX Chain Analysis And Risk Monitoring PortalAccording to Foresight News, Chaos Labs, an on-chain risk analysis platform, has launched a dYdX Chain analysis and risk monitoring portal to support the dYdX Chain and its incentive program. The monitoring portal offers not only dynamic leaderboards but also in-depth insights and risk assessment features, as well as real-time tracking and visibility into the incentive program.

- Oct 29, 2023 1:34 pmChaos Labs proposes lowering CRV liquidation threshold on Aave V3 PolygonChaos Labs launched a proposal to "reduce the CRV liquidation threshold (LT) on Aave V3 Polygon" in the Aave Governance Forum. As market liquidity for CRV has dropped significantly, the proposal aims to address this issue by lowering the liquidation threshold for CRV on Aave V3 Polygon; the goal is to reduce CRV-related risk exposure and reduce its borrowing capacity, allowing it to be more accurately Be consistent with existing market conditions and other deployed parameters. Chaos Labs recommends reducing its LT by 15%, from 65% to 50%. Chaos Labs noted that the next step will be to submit ARFC for snapshot voting for final approval based on community feedback. If consensus is reached, an Aave Improvement Proposal (AIP) will be submitted to implement the proposed update.

- May 26, 2023 4:23 pmChaos Labs Partners with Uniswap Foundation to Launch Uniswap V3 TWAP Oracle Risk PortalBlockchain risk analytics firm Chaos Labs has partnered with the Uniswap Foundation to launch the Uniswap V3 TWAP Oracle Risk Portal, which highlights the real-time costs of TWAP manipulation in V3 pools. The TWAP market risk application quantifies real-time manipulation risk across all V3 pools and deployments using pool data, including liquidity depth and drain prices, allowing users to view manipulation costs across all pools. The portal incorporates real-time centralized liquidity allocation into quantifying the cost of manipulation and quantifies the capital requirement to move the current spot price as well as quantifies the capital requirement to move TWAP within a 30-minute window, allowing users to simulate how additional liquidity could build up over a specific time period Manipulated capital needs.