How is this bull market different from previous bull markets?

Author: David Canellis, Blockworks; Translator: Baishui, Golden Finance

If you believe in the great fractal energy, then it will completely determine the price of Bitcoin in the next few months.

As far as we know, Bitcoin hit an all-time high of nearly $73,740 in March, which was the peak of the current cycle.

That would mean that the bull run is over. Bitcoin and Ethereum are trading down 5% today - causing losses for almost all other currencies except stablecoins - which certainly doesn't help boost market sentiment.

But the problem with markets is that you never know when they will peak.

Looking back, Bitcoin's all-time high in December 2017 was clearly the top point for the next three years, even if altcoins will continue to rise for a few more weeks.

When Bitcoin first broke above $61,000 in March 2021, it was not confirmed that Bitcoin would plunge another 13% by November (just eight months later) after retracing nearly in half.

At some point, it became clear that the bull run had run its course. The bears may have made that point earlier than the bulls, but the ensuing Terra implosion in May and the subsequent cascading liquidations and bankruptcies really nailed it regardless.

When it comes to price, all we can really do is look backwards. It has been 585 days (about 20 months) since Bitcoin bottomed in November 2022, which for convenience we will refer to as the start of the current bull run.

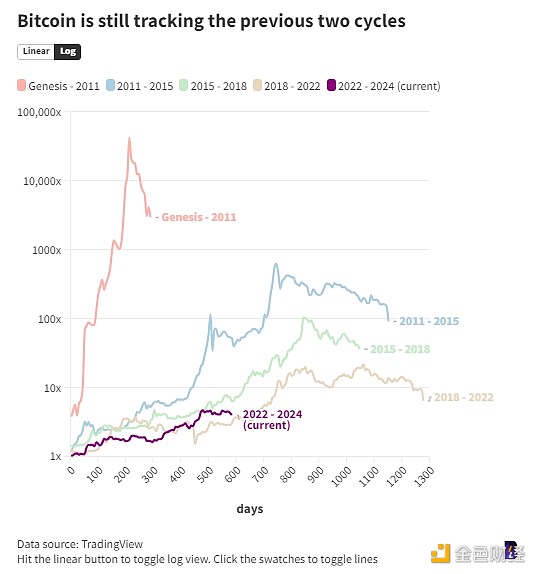

This chart depicts the contrast between bull markets. So far, so good.

Using this very basic definition, the first two bull markets peaked after about 840 and 1,060 days. So if we are destined to repeat these periods - a big if - then we are firmly in the second half of the cycle.

In the past two quarters, Bitcoin’s price has increased 6x and 3x, respectively. Even after the recent drop, Bitcoin’s return since bottoming out is now 4x year to date, putting it in the middle of its recent bull run.

If Bitcoin did indeed peak in March, it would be the shortest bull run cycle on record, not including its first year of price discovery.

In the past two bull runs, most of Bitcoin’s gains occurred in the following 200 days, with gains of 20x and 100x from the bottom, respectively.

We know that each cycle has diminishing returns — so whatever moves Bitcoin does may not be as explosive. That could leave crypto investors eager to take big profits elsewhere. Historically, altcoin seasons have helped close the gap.

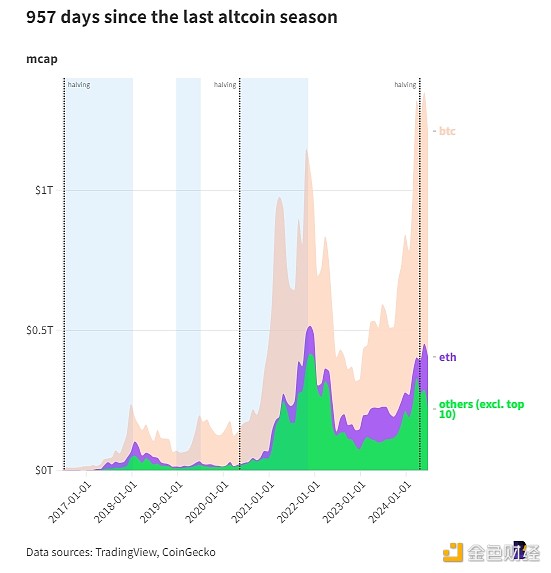

But as is now well documented, there has been no altcoin season so far in this cycle, at least not in the same sense as in previous periods.

According to the definition outlined in the last edition of the Empire Newsletter, there have been three distinct altcoin seasons in the past seven years. Two of them coincided with the Bitcoin halving, and each ran for about a year and a half and ended when Bitcoin peaked.

Bitcoin halving is marked with a dotted line and altcoin season is marked in blue

A shorter altcoin season lasted nearly seven months from late 2018 to the middle of the following year.

This time around, neither ETH nor TradingView’s OTHERS index, which tracks the market capitalization of all cryptocurrencies outside the top 10, has recovered to its all-time high valuations since 2021.

Altcoin season will either be late or not come at all, depending on how bullish or bearish you are.

Either way, the outcome of this bull run will be very different from the others to date.

Live Updates

- Jun 25, 2024 3:29 pmDePin Tokens Outperform as the Crypto Market BleedsDecentralized physical infrastructure network (DePin) tokens have surged in the last 24 hours, outperforming the broader crypto market. After Bitcoin’s decline to below $58,500, DePin tokens strongly rebounded. This sector represents not just the cutting edge of technological adaptability but also a promising frontier for investors seeking to capitalize on the next wave of crypto-led... source: https://beincrypto.com/depin-tokens-soar-bitcoin-struggles/

- Jun 25, 2024 3:29 pmDePinトークン、暗号資産市場の出血でアウトパフォーム分散型物理インフラネットワーク(DePin)トークンは過去24時間で急騰し、より広範な暗号資産をアウトパフォームした。ビットコインが58,500ドルを下回るまで下落した後、DePinトークンは強く反発した。 このセクターは、技術的適応性の最先端を表しているだけでなく、暗号資産主導のイノベーションの次の波に乗ろうとする投資家にとって有望なフロンティアでもある。 Arweave、Render、Akash NetworkがDePinの反発を牽引 CoinMarketCapによると、DePinセクターは過去24時間で7.49%増加した。時価総額は現在258億ドルとなっている。 時価総額に基づくDePinトークンのトップ10の中で、Arweave (AR)は過去24時間で12.71%上昇し、トップパフォーマーとなっている。続いてRender... source: https://jp.beincrypto.com/depin-tokens-soar-bitcoin-struggles/

- Jun 25, 2024 3:25 pmBillionaire Mark Cuban Starts Selling NFTs After Two YearsMark Cuban has sold a part of his 1,900 ETH NFTs collection, including a Pudgy Penguin for more than $30,000, as revealed by one of his OpenSea wallets. source: https://cryptonews.com/news/billionaire-mark-cuban-starts-selling-nfts-after-two-years.htm

- Jun 25, 2024 2:59 pmTop Analysts Predict Bitcoin’s Next Price Moves, Warning of Potential Market DownturnBitcoin’s key support levels are under scrutiny as analysts predict potential price declines that could ripple across the cryptocurrency market, according to the latest Forbes analysis. Forbes’ analysis emphasized Bitcoin’s critical support levels that may become relevant if the world’s largest cryptocurrency falls below its current threshold. The predictions, shared by leading industry... source: https://coinedition.com/top-analysts-predict-bitcoins-next-price-moves-warning-of-potential-market-downturn/

- Jun 24, 2024 11:34 pmEther ETF Launch Already Priced In? Analyst Predicts Drop to $3,000 Due to This Crucial FactorAndrew Kang, co-founder of Mechanism Capital, believes that the market has already priced in the launch of a spot Ethereum exchange-traded fund (ETF). source: https://zycrypto.com/ether-etf-launch-already-priced-in-analyst-predicts-drop-to-3000-due-to-this-crucial-factor/

- Jun 24, 2024 11:26 pmBLAST Token Experiences Significant Price DropAccording to BlockBeats, the BLAST token has experienced a significant decrease in its futures price on the Whales Market platform. As of June 24, the futures price of the BLAST token was reported to be $0.0383, marking a 24-hour drop of 25.2%. In addition to the price drop, information from the BLAST token blockchain indicates that the total volume of the token is 100 billion. This information provides insight into the scale of the BLAST token's presence in the cryptocurrency market. The significant drop in the futures price of the BLAST token on the Whales Market platform is a noteworthy event in the cryptocurrency market. The 25.2% decrease over a 24-hour period indicates a substantial shift in the market's valuation of the token. The total volume of the BLAST token, as indicated by the blockchain information, further underscores the scale of this event. This news comes as a reminder of the volatility inherent in the cryptocurrency market. Investors and market watchers alike will likely be keeping a close eye on the BLAST token's performance in the coming days.

- Jun 24, 2024 9:54 pmتراجع كبير تسجله عملة ORN الرقمية.. فما السبب وراء ذلك؟سجلت عملة ORN الرقمية تراجع كبير وملحوظ اليوم على منصة بينانس الرقمية، فقد وصل سعرها إلى 1.382 دولار، وهو ما يمثل انخفاضًا بنسبة 13.71% عن السابق، كما انخفضت القيمة السوقية الإجمالية لعملة ORN إلى 49.44 مليون دولار. وبلغ سعر عملة ORN الرقمية أثناء كتابة المقال 1.452 مع استمرار العملة بالانخفاض. أما عن حجم تداول عملة … source: https://btcacademy.online/%d8%aa%d8%b1%d8%a7%d8%ac%d8%b9-%d9%83%d8%a8%d9%8a%d8%b1-%d8%aa%d8%b3%d8%ac%d9%84%d9%87-%d8%b9%d9%85%d9%84%d8%a9-orn-%d8%a7%d9%84%d8%b1%d9%82%d9%85%d9%8a%d8%a9-%d9%81%d9%85%d8%a7-%d8%a7%d9%84%d8%b3/

- Jun 24, 2024 9:19 pmQCP캐피털 "BTC 급락, 마운트곡스 7월 초 채권 상환 시작 발표 탓"싱가포르 소재 암호화폐 거래 업체 QCP캐피털이 공식 텔레그램 채널을 통해 "오늘 비트코인 급락은 마운트곡스의 회생수탁사가 7월 초 비트코인 및 비트코인캐시(BCH) 채권 상환을 시작한다고 발표했기 때문"이라고 분석했다. 이어 QCP캐피털은 "마운트곡스는 채권 상환 시점을 수 차례 연장했지만, 실제 상환일이 다가오자 올해 초부터 약 90억 달러 상당의 BTC를 이체하기 시작했다. 7월 만기 옵션 시장에는 급격한 거래 활동이 포착되지 않았다. 이는 시장이 마운트곡스의 채권 상환에 의한 변동성을 예측하지 못했음을 시사한다. BTC 현물 가격이 6만 달러 지지선 위해서 안정화되면, 7월 예상할 수 있는 특별한 이슈는 없을 것으로 예상되므로 장기 매집 전략을 추천한다"고 설명했다.

- Jun 24, 2024 8:45 pm솔라나(SOL), 지원 약화로 수개월 만에 최저치 기록솔라나(SOL) 가격은 비트코인과 다른 모든 알트코인이 빨간색 캔들 스틱으로 설정한 경로를 따르고 있습니다. 그 결과 회복 가능성은 날이 갈수록 낮아지고 SOL 보유자들도 희망을 잃고 있습니다. 솔라나 투자자들의 하락에 대한 반응 솔라나의 가격은 광범위한 시장 신호로 인해 회복에어려움을 겪을 수 있습니다. 이는 이동평균 수렴 발산 지표(MACD)에서 확인할 수 있습니다. MACD는 증권 가격의 두 이동 평균 간의 관계를 보여주는 추세 추종 모멘텀 지표입니다. 이 평균의 교차를 기반으로 잠재적인 매수 또는 매도 신호를 식별하는 데 사용됩니다. 솔라나의 MACD는 한 달 넘게 약세 크로스오버를 보이고 있으며, 이는 가격 추세의 지속적인 하락 모멘텀을... source: https://kr.beincrypto.com/base-news/63271/

- Jun 24, 2024 8:23 pmEthereum Investors Continue to Purchase ETH! What Level Do They Target for September? Here are Ethereum Option Figures!Investors are actively buying Ethereum options with a $4,000 strike price expiring in September on the Deribit exchange. Continue Reading: Ethereum Investors Continue to Purchase ETH! What Level Do They Target for September? Here are Ethereum Option Figures! source: https://en.bitcoinsistemi.com/ethereum-investors-continue-to-purchase-eth-what-level-do-they-target-for-september-here-are-ethereum-option-figures/