Ethereum Merge: How will the PoS transition impact the ETH ecosystem?

The Ethereum blockchain is on the verge of one of the most crucial technical updates since its inception, moving from proof-of-work (PoW) to proof-of-stake (PoS), also called Ethereum 2.0, or Eth2.

Ethereum devs gave Sept. 19 as the perpetual date for the merger of the current PoW chain to the PoS chain. The Merge is expected to be deployed on the Goerli testnet in the second week of August. After the successful integration of the Goerli testnet, the blockchain will initiate the Bellatrix update in early August and roll out the Merge two weeks later.

The discussion around the transition began with a focus on scalability, so Ethereum developers proposed a three-phase transformation process. The transition itself is nearly two years in the making, starting on December 1, 2020, with the launch of Beacon Chain, initiating Phase 0 of the three-phase process.

The Beacon Chain began the shift to PoS, enabling users to stake their Ether (ETH) and become validators. However, Phase 0 did not affect the main Ethereum blockchain: The Beacon Chain exists alongside Ethereum’s mainnet. However, both the Beacon chain and mainnet will eventually be linked with the Merge.

Phase 1 was meant to launch in mid-2021 but was delayed to early 2022, with developers citing unfinished work and code auditing as major reasons. From Phase 1 onward, Eth2 will house Ethereum’s entire history of transactions and support smart contracts on the PoS network. Stakers and validators will officially step into action, as Eth2 will take mining out of the network.

Phase 2, the final phase of the transition, will see the introduction of Ethereum WebAssembly, or eWASM, over the current Ethereum Virtual Machine (EVM). WebAssembly was created by the World Wide Web Consortium and is designed to make Ethereum significantly more efficient than it currently stands. Ethereum WebAssembly is a proposed deterministic subset of WebAssembly for the Ethereum smart contract execution layer. The eWASM was specifically designed to replace the EVM, which would see implementation in Phase 2.

Marius Ciubotariu, co-founder of Hubble Protocol — a decentralized finance (DeFi) lending platform — told Cointelegraph that he is not really worried about the delays, as any new technology with such vast implications on the ecosystem would take time:

“PoS is not live yet; however, I do not see this as a concern. I understand the Merge has taken longer than some would expect. But, with new technology and the opportunity for critical issues, a non-rushed approach is the best one. As this Merge goes live, I’m confident more protocols will show up. We’ll continue innovation within the Ethereum community; something I have and continue to enjoy seeing/experiencing.”

Merge’s impact on the Ethereum ecosystem

Barney Chambers, co-founder and co-lead developer at cross-chain DeFi platform Umbria Network, told Cointelegraph that the Merge will be challenging:

The upcoming Merge will see the current PoW mainnet merge with the Beacon Chain, transferring the whole Ethereum history to the new chain. A complete change of consensus for an ecosystem as large as Ethereum will have a dramatic impact from both a technical and political perspective.

“The accumulation of Ethereum will centralize in the hands of validators who already hold the majority of the tokens. The Ethereum Foundation claims that the merge will not impact the price of Ethereum, but the Merge will cause a fundamental shift in the way that new tokens are distributed and this will have a dramatic effect on the price of both Ethereum and the entire cryptocurrency ecosystem.”

The proof-of-work mining difficulty level will skyrocket due to the difficulty bomb, making it unable to conduct mining at economically viable scales. The difficulty bomb is a code ingrained in the Ethereum protocol since 2015. It is set to execute every time a specific number of blocks have been mined and added to the blockchain. It makes the mining activity on the existing proof-of-work blockchain significantly harder.

Recent: Metaverse visionary Neal Stephenson is building a blockchain to uplift creators

As a result, Ethereum’s proof-of-work chain would be compelled to stop generating blocks, as the difficulty bombs would make mining a block nearly impossible. This situation is described by its developers as an “Ice Age.” The bomb’s simple goal is to encourage miners to merge completely, which will increase the adoption of the proof-of-stake chain.

The transition to a new PoS network became necessary for Ethereum, given its expanding ecosystem leading to several network congestion and very high gas fees. Over the past year, however, the narrative has also shifted toward PoS being more environment-friendly than PoW. While some laud Eth2 as paving the way for a more environmentally friendly protocol, Patricia Trompeter, CEO of carbon-neutral crypto mining company Sphere3D, has other thoughts. Trompeter told Cointelegraph:

“PoS only leads to unnecessary spending and misallocated energy resources, as ‘Band-Aid solutions,’ and marketing schemes like the ‘Change The Code’ campaign don’t offer any solutions to a full industry shift toward renewable resources.”

Patricia believes PoS rather dismantles crypto’s decentralized infrastructure, “pushing power toward the wealthiest holders with unimpeachable control over users.”

Post-Merge, ETH issuance would drop to about 0.6 million per year, with a similar 2.7 million ETH burned, meaning a net 2.1 million ETH burned per year, or -7% in yearly ETH supply, making it a deflationary asset. ETH miners will be out of business officially once the difficulty bomb hits, being forced to mine other PoW coins with the same hashing algorithm for their existing equipment or fully exit the market.

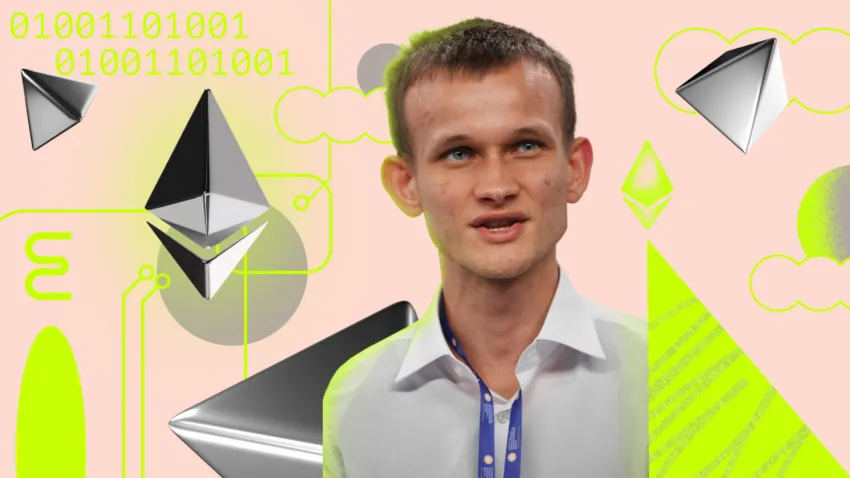

Ethereum co-founder Vitalik Buterin has predicted that the transition would not only help scale the network but also bring down the energy consumption by 95%. The transaction processing speed is expected to get on par with centralized payment processors. However, none of these features would arrive with the Merge on Sept. 19.

The major scalability solution called sharding that allows for parallel transaction processing will only arrive after the completion of Phase 2, which is expected to take place in the second half of 2023.

Daniel Dizon, co-founder and CEO of noncustodial and liquid ETH staking protocol the Swell Network, told Cointelegraph:

“The Merge represents a significant change to Ethereum’s underlying economic model and hardware requirements, resulting in massive energy output reduction. It is expected there will be a significant demand for ETH as the rewards from participation in ETH staking will be increasing significantly from priority fees and MEV capture. The implication of the Merge is not fully priced in. Increased demand and reduced issuance for ETH will result in structural upward pressure on price compared to the existing state of Ethereum today.”

Does the Merge make Ethereum a security?

Apart from the technical and financial impact of the Merge, the biggest discussion seems to be around whether Ether would qualify as security once the network makes the move to PoS. The discussion has gained a lot of steam online in recent days and the answer to the question would depend on who you ask.

The debate around Ethereum’s security status was prevalent long before the transition to PoS came into the picture. The debate gained a lot of momentum after the United States Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, deeming its sale of Ripple (XRP) tokens as a security.

Many XRP proponents have since pointed to the “pre-mine” of Ethereum and have often blamed the SEC for giving Ethereum a free pass. The confusion and dilemma around security status arise from a lack of clear regulations for the crypto market. While lawmakers agree that Bitcoin (BTC) can be regarded as an independent asset class, the status of Ethereum has been a topic of debate.

Adam Levitin, a research professor at Georgetown University Law Center, outlined what could make the PoS-based Ethereum network a security in the eyes of regulators:

I've gotten some pushback here, so let me elaborate. "Security" includes an "investment contract." "Investment contract" is defined by SCOTUS in Howey as a K for investment in a common enterprise where profits are expected "solely from the efforts" of a third party. 2/

— Adam Levitin (@AdamLevitin) July 24, 2022

He added that “Howey speaks of an investment of ‘money,’ but that has always been interpreted just to mean an investment of value. Putting up a stake readily satisfies this element.”

Recent: Decentralized storage providers power the Web3 economy, but adoption still underway

Coin Metrics co-founder Jacob Franek countered Levitin’s argument, suggesting that Ethereum is one of the most decentralized platforms with open source support.

3/ Is there an issue with disclosures today?

— Jacob Franek (is Hiring) (@panekkkk) July 24, 2022

Ethereum is an open-source, distributed project.

It arguably has the most transparent and real-time disclosures of any distributed project and certainly more than a traditional, centralized company.

Another major concern about the PoS transition has been the centralization in the decision-making process. Konstantin Boyko-Romanovsky, CEO of reward-monitoring and block transactions validation platform Allnodes, told Cointelegraph:

“While the risk of centralization with Ethereum’s new consensus mechanism PoS exists, it is ways away from being realized. So far, the strong community behind the Ethereum network has tackled every challenge, and there is no reason to assume that the issue of centralization won't be resolved either.”

The Ethereum blockchain has become the backbone of the DeFi, nonfungible tokens and decentralized autonomous organizations. While the ecosystem will continue to support such nascent use cases, the true transition to PoS with sharding and high scalability features will only be available after 2023. The success of Eth2 will highly depend on the execution of the final phase, but many market pundits are still skeptical about it, given the past delays.

More news about イーサリアム pos

- Dec 28, 2023 8:37 amEthereum Co-founder Vitalik Buterin Proposes PoS Simplification PlanAccording to Foresight News, Ethereum co-founder Vitalik Buterin has published an article titled 'Persisting with 8192 Signatures per Slot After SSF: How and Why,' in which he explains a Proof of Stake (PoS) simplification proposal. Buterin states that the Ethereum blockchain currently processes a large number of signatures, leading to high loads and significant technical sacrifices. As a result, he proposes a design plan that requires only 8192 signatures per slot (even when using SSF) to make consensus implementation simpler and lighter. Buterin also presents three methods for achieving this goal: focusing on decentralized staking pools; two-tier staking; and taking turns participating, such as through committees. The proposed changes aim to improve the efficiency and scalability of the Ethereum blockchain while maintaining its decentralized nature.

- Sep 17, 2022 7:07 pmData: 99% of Ethereum clients already support the Ethereum PoS chainAccording to EtherNodes data, 99% of the Ethereum clients already support the Ethereum PoS chain. Among them, the Ethereum clients Erigon, Besu, and Nethermind have 100% completed the support upgrade for the PoS chain. Geth, which is currently the most used, has a completion rate of 99%.

- Sep 15, 2022 3:33 pmEthereum's first PoS block reward exceeds $72,000According to the monitoring of the OKLink multi-chain browser, at 14:42 on September 15th, Beijing time, the execution layer of Ethereum (that is, the previous main network) and the consensus layer (that is, the beacon chain) triggered the merge mechanism at block height 15537393. The height of the first PoS block is 15537394, and the block reward is as high as 45.03 ETH, which is worth over $72,000 at current prices.

- Sep 15, 2022 10:52 amData: 88% of Execution Layer Clients Ready for Ethereum PoS MergeAccording to EtherNodes data, 88% of the current execution layer clients are ready for the Ethereum PoS merger, and 12% of the execution layer clients have not yet been upgraded to the latest version that supports the merger. Among the four execution layer clients, Go-Ethereum (Geth) accounts for 87% of clients ready to merge, Erigon for 92%, Besu for 99%, and Nethermind for 91%.

- Sep 13, 2022 9:28 pmTHORChain will suspend Ethereum services 1 hour before the merger of Ethereum, and only support the PoS chain after the mergerTHORChain will suspend Ethereum services 1 hour before the merger of Ethereum, and will only support the PoS chain after the merger. THORChain stated that users do not need to take any action.

- Sep 09, 2022 3:57 pmStarkWare will only support PoS chains after the Ethereum merger completesStarkWare will only support the PoS chain after the merger of Ethereum is completed. SyarkNet users do not need to do anything if they need to transfer funds to the PoS chain. If they want to interact with the PoW chain, they need to withdraw Ethereum before the merger.

- Sep 09, 2022 11:41 amMaker protocol will only support PoS chains after Ethereum completes the mergerMakerDAO tweeted that the Maker protocol will only support the PoS chain after the merger of Ethereum is completed, and users do not need to take any specific actions to keep their Maker Vault running normally. In addition, MakerDAO also reminds users to be careful of replay attacks.

- Sep 01, 2022 9:15 amOpenSea: After the merger of Ethereum, it will only support the Ethereum PoS chainOpenSea, an NFT trading market, stated on Twitter that after the merger of Ethereum, it will only support the Ethereum PoS chain and will not support potential forked chains. In addition, OpenSea is currently preparing for a smooth transition of the product.

- Aug 11, 2022 8:42 pmJPMorgan Chase: ETC or one of the main beneficiaries of Ethereum's shift to PoSAccording to CoinDesk, JPMorgan Chase released a report stating that Ethereum mining is dominated by GPU equipment and can be more easily reconfigured to mine other cryptocurrencies such as Ethereum Classic (ETC), Ravencoin and Ergo. A sudden influx of large mining pools into another coin could squeeze the profits of existing miners. Those Ethereum miners using ASIC devices have few options other than ETC, so ETC miners may be one of the main beneficiaries of this shift. There are signs that this shift to ETC is already happening.

- Aug 09, 2022 11:31 pmCircle: will only support the Ethereum PoS chain after the Ethereum merger is completeCircle issued a document stating that it will only support the Ethereum PoS chain after the completion of the Ethereum merger. It is expected that USDC’s on-chain functions or fully automatic issuance and redemption services will not be interrupted. Previously, Tether CTO Paolo Ardoino stated that support for ETH2 will be seamless and that Tether "plans to support ETH2."