Cryptocurrency analysts say: Bitcoin ETF demand may rise

Young Ju pointed out that the on-chain cost base of new BTC whales is approximately $56,000, and it is expected that if BTC reaches this price level, a large amount of capital will pour in Spot Bitcoin ETF Market.

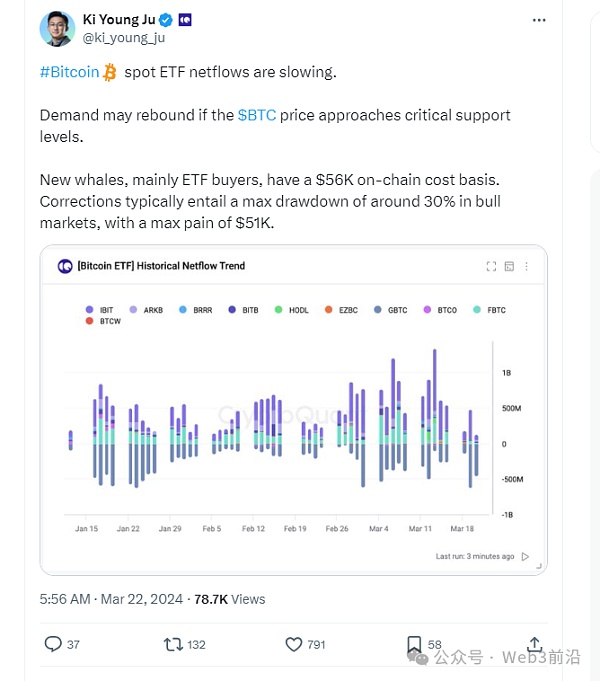

Against the backdrop of falling Bitcoin prices, the recent Bitcoin ETF spot market has been bleak. Despite continued declines in net flows, prominent analyst and CEO of CryptoQuant Ki Young Ju predicts that the spot Bitcoin ETF market may recover.

On March 22, Ki Young Ju posted on X that even if the price of BTC continues to fall, spot Bitcoin ETF net flows may rise. Using data from historical net flow trends, the analyst noted that demand for a Bitcoin ETF typically arises when the cryptocurrency tracks a certain support level.

These BTC ETFs have recorded negative flows over the past four trading days, according to data from analytics firm BitMEX Research. The situation was marked by significant outflows from Grayscale’s GBTC, while other ETFs (mainly market leader BlackRock’s IBIT and Fidelity’s FBTC) saw record low inflows.

Young Ju noted that new BTC whales, especially ETF buyers, have an on-chain cost base of approximately $56,000. This shows that significant Bitcoin holders, especially ETF investors, typically purchase Bitcoin at an average price of $56,000.

Based on this model, cryptocurrency quants expect significant inflows into the spot Bitcoin ETF market if BTC reaches the above price threshold.

Bitcoin

$64,606

Prices have fluctuated between $62,000 and $68,000 over the past week. However, Young Ju said the drop is reasonable considering adjustments typically fall by up to 30%. With BTC recently peaking at $73,750, analysts predict that the asset’s price could drop to $51,000.

However, in the past 48 hours, the price of BTC fell by 13% from an all-time high of $73,835, once falling to near $60,000. The correction is due to overheating in the market, which analysts refer to as a "pre-halving retracement," and comes about 30 days before Bitcoin's halving event.

A report from CryptoQuant shows that given that investment flows from new investors are relatively low and price valuation indicators remain below the levels of past market tops, Bitcoin’s The coin bull market cycle is not over yet.

At the same time, the upcoming Bitcoin halving event is expected to drive up the price of Bitcoin, ushering in a parabolic upward trend. According to CoinMarketCap’s halving countdown, there are less than 31 days until Bitcoin’s next halving event.

More news about 暗号通貨アナリスト

- Feb 07, 2024 11:27 am暗号資産アナリストが注視する「強さを見せる」5つの暗号資産暗号資産アナリストのMiles Deutscherは、暗号資産が直面している不安定な市場を宣言し、一般的なトレンドに抵抗する暗号トークンのトップピックを概説している。 同氏は特に、最近停電に直面したが、この不確実な時期にかなり持ちこたえたSolanaに注目している。 暗号資産アナリストMiles... source: https://jp.beincrypto.com/5pqx5y36loh55sj44ki44ok44oq44k544oi44cb44oe44kk44or44k544o744oj44kk44ob44knleaalwptmamuiyqa/

- Jan 27, 2024 8:53 pmCryptocurrency Analysts Recommend Nigeria SEC to Revise Exchange Licensing GuidelinesNigeria’s cryptocurrency analyst Rume Ophi says the Nigeria Securities and Exchange Commission’s (SEC) cryptocurrency licensing requirements should revisit the Virtual Asset Service Provider (VASP) guidelines to enable local cryptocurrency exchanges to obtain licenses to operate in the country. . Ophi stated that the existing guidelines provided by the Nigerian SEC are not conducive to local cryptocurrency exchanges and that it should prioritize local exchanges when formulating guidelines. In order to obtain a VASP license from the Nigerian SEC, local exchanges must comply with application process requirements, pay registration fees and other applicable fees. Ophi noted that many local exchanges cannot afford the minimum initial capital requirement of N500 million (approximately $556,620), which he said will result in mainly foreign exchanges operating in Nigeria. Web3 Nigeria legal representative Kue Barinor Paul supported Ophi’s sentiments and said that Nigeria’s cryptocurrency exchanges and VASPs may need to merge to meet the Nigeria SEC’s licensing requirements. Paul said the Nigeria SEC needs to rework the licensing registration framework as the current requirements are largely friendly to foreign exchanges. In May 2022, the Nigerian SEC issued "New Regulations on Digital Asset Issuance, Trading Platforms and Custody." Ophi further stated that the National Assembly of Nigeria needs to be involved to ensure that the licensing requirements of the Nigerian SEC are in line with the realities of the country’s economy. (Cointelegraph)

- Dec 29, 2023 1:41 pmAnalyst: Cryptocurrencies are expected to account for 20% of technology stock market value by 2025Former Bloomberg Intelligence analyst Jamie Coutts CMT wrote on the X platform that by the end of 2025, technology stocks are expected to account for 25% of the total global stock market. This number has doubled in the past ten years; It is expected to account for 20% of the value of technology stocks (increased to 5 times in 5 years). Coutts believes that technology stocks and cryptocurrencies are likely to be the largest overweights in portfolios for at least the next 1-2 years until the liquidity cycle turns.

- Dec 23, 2023 11:00 amBitfinex Analyst: The overall market value of cryptocurrencies will reach $3.2 trillion in 2024Bitfinex analysts say 2024 is a bullish year. In the event of historical corrections and market oscillations, the potential market capitalization of the crypto economy will increase to $3.2 trillion. The latest Bitfinex Alpha report claims that the Cryptocurrency Fear and Greed Index has turned to “extreme greed,” indicating that Bitcoin is at mid-bull market highs and the market is in a dynamic phase. Bitfinex researchers explain that the growing interest of institutional investors in crypto assets, especially Bitcoin, is crucial. The highly anticipated spot Bitcoin ETF has acted as a catalyst, potentially moving some funds into riskier crypto assets. Bitcoin is expected to maintain its favored status in institutional portfolios, especially in the first half of 2024, Bitfinex strategists said. (Bitcoin.com)

- Dec 11, 2023 1:53 amCrypto analyst identifies potential rally setup on Bitcoin chartCharles Shrem, also known as Blockchain Backer, a prominent cryptocurrency analyst, has spotted a setup on the Bitcoin chart reminiscent of conditions preceding the 2020 rally. Shrem suggests that both Bitcoin and altcoins could be poised for significant price surges similar to what was witnessed in 2020. His analysis is based on comparing the current ... source: https://www.cryptopolitan.com/crypto-analyst-on-bitcoin-chart/

- Nov 28, 2023 8:45 amJito Labs Launches Governance Token JTO for Managing Jito NetworkAccording to Foresight News, Jito Labs, a Solana ecosystem MEV infrastructure developer, has introduced its governance token, JTO. The token will be used to help manage the Jito network, aiming to enable community members to have a direct impact on the network's decisions and direction. This includes setting fees for the JitoSOL staking pool, updating delegation strategies by controlling StakeNet program parameters, managing the treasury of JTO tokens held by the DAO and fees generated by JitoSOL, and contributing to the ongoing development and improvement of Jito protocols and products. The total supply of JTO tokens is 1 billion, with 59.3% allocated to the foundation. Of this, 10% will be airdropped, 24.3% will be directly controlled by token holders through Realms, and the remaining 25% will be donated to the foundation to fund and lead large-scale strategic relationships.

- Nov 22, 2023 10:54 pmCrypto Analyst: Ripple Making Connections Amid Binance TurmoilThe crypto analyst behind the JWK Show YouTube channel posted a video on Nov. 22nd highlighting recent allegations against crypto exchange Binance. He speculated that this could trigger a “bank run” and collapse similar to FTX. The host pointed to institutions capitalizing on the opportunity, highlighting a recent tweet from Grayscale touting its Grayscale Ethereum Trust as the world’s largest Ethereum (ETH) investment vehicle: We have Grayscale coming in, Wall Street never loses. You might also like: Crypto analyst predicts XRP breakout soon In addition, JWK also found links between Binance and Ripple, the firm behind the XRP token. He noted that the new Binance CEO Richard Tang previously shared a stage with Ripple’s European chief. Interesting connections being made with Ripple and Binance. Obviously all these people are puppets at the end of the day and this was all pre-planned as well Richard is a highly qualified leader and with over three decades of financial services and regulatory experience. Read more: What is Render, and why is it 50% up this week?

- Nov 09, 2023 6:18 pmJPMorgan analyst: Cryptocurrency rally appears overdone, cautious about its outlookJPMorgan analysts said: "The cryptocurrency rally appears to be overdone." They are cautious about the future of the crypto market. (The Block)

- Oct 07, 2023 8:30 amAnalyst: Cryptocurrency market could rebound in December and JanuaryOdaily Planet Daily News Cryptocurrency trader and analyst Altcoin Sherpa posted on the X platform that December and January are “the absolute best time of the year to trade/buy cryptocurrencies.” BTC almost always performs well during this period, even in bear markets. ETH also tends to outperform the rest of the altcoin market in December and January, which typically leads to altcoin trading season. Sherpa said that December and January are the golden periods for Bitcoin’s trend. These two months have always rallied at times over the past few years, and so has ETH (despite its poor performance last year).

- Mar 30, 2023 9:29 pmCiti Analyst: CBDC and Tokenization Will Drive Mass Adoption of CryptocurrenciesThe next influx of crypto adoption will be driven largely by central The rise and tokenization of bank digital currencies (CBDCs) is driving real-world assets. Meanwhile, Ronit Ghose, the bank's future head of finance, said that in ten years' time, the economic circulation in CBDC will reach $5 trillion, most of which will not be blockchain-based, but some of which will have blockchain interoperability specific or specific to distributed ledger technologies. Citi estimates that tokenization could grow 80-fold in the private market, reaching a value of nearly $4 trillion by 2030.