Coingecko: Who are the top Ethereum ETFs and which countries have Ethereum ETFs?

Author: Lim Yu Qian, Coingecko; Compiler: Deng Tong, Golden Finance

What are the top Ethereum ETFs in the world?

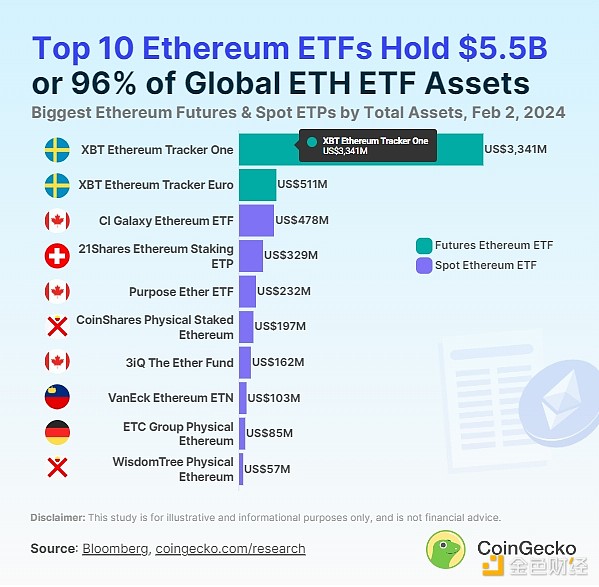

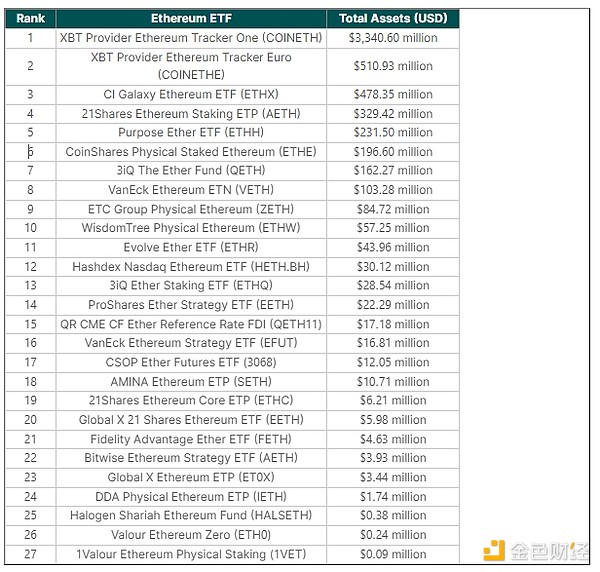

XBT Ethereum Tracker One (COINETH) is the world’s top Ethereum exchange-traded fund (ETF) , the largest asset size so far, reaching US$3.34 billion. Another offering from the same provider, XBT Ethereum Tracker Euro (COINETHE), is the second-largest Ethereum ETF with total assets of $510.93 million. COINETH and COINETHE are both Ethereum futures ETFs traded in Europe.

COINETH and COINETHE launched together in October 2017 as the world’s first Ethereum ETF, followed by Grayscale’s launch of the Ethereum Trust in December.

The number one Ethereum ETF is Canada’s CI Galaxy Ethereum ETF (ETHX) with total assets of $478.35 million. Europe’s 21Shares Ethereum Collateral ETP (AETH) is the second-largest spot Ethereum ETF. AETH has total assets of $329.42 million and was launched in 2019 as the world’s first spot Ethereum ETF.

The top ten global Ethereum ETFs are all traded in Canada or Europe. In comparison, the U.S. Ethereum ETF ranks 14th or lower. At the same time, the U.S. SEC continues to delay its decision on the Ethereum ETF spot application, and it remains to be seen whether the United States can catch up with Canada and Europe.

How many Ethereum ETFs are there?

There are currently 27 active Ethereum ETFs in the world, with total assets of US$5.7 billion. Their total asset size is still smaller than that of Grayscale Ethereum Trust (ETHE), which has total assets of $6.76 billion.

It is worth noting that the top 10 largest Ethereum ETF assets are as high as $5.49 billion, accounting for 96.4% of total assets. This suggests that a handful of players dominate the Ethereum ETF market, despite more products and providers entering the market.

Among the 27 Ethereum ETFs in the world, 20 are only Ethereum spot ETFs and 7 are only Ethereum Futures ETFs. However, Ethereum futures ETF assets total $3.91 billion (68.5%), more than double the Ethereum spot ETF’s $1.8 billion (31.5%) assets. If the U.S. SEC approves the spot Ethereum ETF and Grayscale’s Ethereum Trust conversion, the spot Ethereum ETF could flip the Ethereum futures ETF.

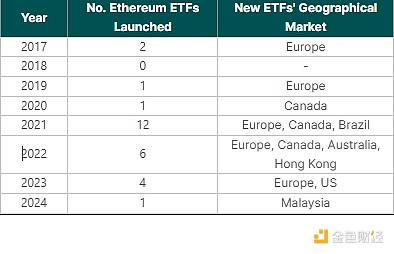

2021 and 2022 are the most popular years for the launch of Ethereum ETF

Following the launch of the Ethereum ETF in 2017, After a batch of Ethereum ETFs, no more Ethereum ETFs were launched in 2018 as the overall crypto market peaked and declined. In 2019 and 2020, Europe and Canada each launched an Ethereum ETF.

Ethereum ETFs gained popularity during the 2021 cryptocurrency bull run, with 12 Ethereum ETFs launched in Europe, Canada and Brazil. TradFi adoption momentum continues, but at a slower pace, with 6 Ethereum ETFs in 2022 and 4 in 2023.

Since 2024, Malaysia has launched 1 Ethereum ETF, namely Halogen Shariah Ethereum Fund (HALSETH).

Which countries have Ethernet ETF?

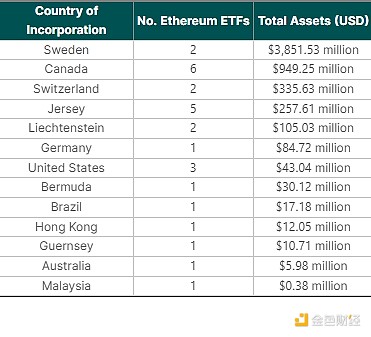

The Ethereum ETF is incorporated in 13 countries around the world and trades on 7 regional markets. Specifically, the Ethereum spot ETF is registered in 10 countries and trades in 5 markets, while the Ethereum futures ETF is registered in only 4 countries and trades in 3 markets.

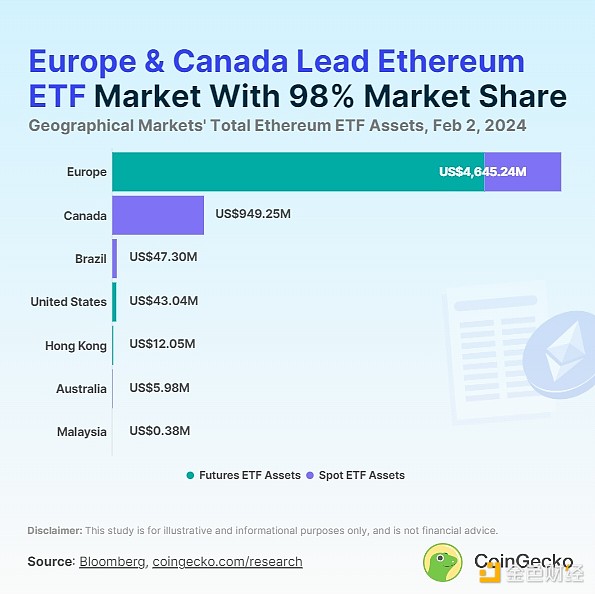

Europe and Canada lead the Ethereum ETF market: Europe has 3 Ethereum futures ETFs and The 10 spot Ethereum ETFs have a total asset size of US$4.65 billion, accounting for 81.45% of the global market share. Canada has 6 spot Ethereum ETFs with total assets of US$949.25 million, accounting for 16.64% of the global market share.

Brazil is the third largest Ethereum ETF market, with 2 spot Ethereum ETFs holding $47.3 million in assets (0.83%), followed by 3 Ethereum futures ETFs in the United States, with total assets of $43.04 million (0.75%) ).

The smaller markets for the Ethereum ETF are Hong Kong (0.21%), Australia (0.10%), and Malaysia (0.01%).

It is worth noting that the United States and Hong Kong only have Ethereum futures ETFs, while Canada, Brazil, Australia and Malaysia Only Ethereum spot ETF. Europe is the only market that offers both futures and spot ETFs.

Countries adopting Ethereum ETF

Global Ethereum futures and spot ETF rankings

As of February 2, 2024, all pure Ethereum futures and spot ETFs in USD Total assets ranking:

More news about eth country

- Apr 23, 2024 10:58 pmBitcoin Exchange Binance is Newly Banned from This Country!The Philippines, where Bitcoin exchange Binance is experiencing problems, demanded that the applications be removed from the Google Play Store and Apple App Store. Continue Reading: Bitcoin Exchange Binance is Newly Banned from This Country! source: https://en.bitcoinsistemi.com/bitcoin-exchange-binance-is-newly-banned-from-this-country/

- Mar 25, 2024 11:23 pmVeto from This Country to Bitcoin Exchange Binance!The Philippine SEC, which tried to block the Bitcoin exchange Binance, said that Binance is a threat to the security of the Philippines. Continue Reading: Veto from This Country to Bitcoin Exchange Binance! source: https://en.bitcoinsistemi.com/veto-from-this-country-to-bitcoin-exchange-binance/

- Mar 25, 2024 10:24 pmPhilippines Blocks Binance’s ‘Online Presence’ in the CountryThe Philippines Securities and Exchange Commission (SEC) cracks the whip on Binance. source: https://dailycoin.com/philippines-blocks-binances-online-presence-in-the-country/?utm_source=cryptopanic&utm_medium=rss

- Mar 15, 2024 12:00 amFirst EU country adopts quantum-resistant technologyThe QAN stack will serve as a key component in the country’s post-quantum security layer. source: https://cointelegraph.com/news/eu-country-quantum-resistant-tech

- Mar 12, 2024 6:14 pmBinance execs detained in Nigerian capital despite country exitSenior Binance execs Tigran Gambaryan and Nadeem Anjarwalla have been detained at a government property since Feb. 26. source: https://cointelegraph.com/news/binance-tigran-gambaryan-detained-nigeria

- Jan 30, 2024 1:10 amEU imposes stricter regulations on third-country crypto firmsIn a bid to safeguard the interests of local investors and ensure compliance with the Markets in Crypto-Assets (MiCA) framework, the European Union (EU) has announced plans to tighten its regulations on crypto companies operating outside the bloc. The European Securities and Markets Authority (ESMA) unveiled a new set of proposals aimed at crypto asset […] source: https://www.cryptopolitan.com/eu-imposes-on-third-country-crypto-firms/

- Jan 29, 2024 11:31 pmEU Reaffirms Stringent Limits on Third-Country Crypto FirmsEU-based customers may have to directly solicit services from third-country crypto firms that want to operate in the bloc. source: https://dailycoin.com/eu-reaffirms-stringent-limits-on-third-country-crypto-firms/?utm_source=cryptopanic&utm_medium=rss

- Jan 04, 2024 6:31 pmAsia's Leading Technology Country Bans Buying Cryptocurrency This Way!Purchasing cryptocurrencies using credit cards would be restricted, according to a proposal made by the South Korean Financial Services Commission. Continue Reading: Asia's Leading Technology Country Bans Buying Cryptocurrency This Way! source: https://en.bitcoinsistemi.com/asias-leading-technology-country-bans-buying-cryptocurrency-this-way/

- Dec 28, 2023 10:42 pmAnother Country Is Introducing Mandatory Rules for Cryptocurrency Exchanges!This country has required crypto exchanges to register with the national crypto assets exchange in order to continue their operations. Continue Reading: Another Country Is Introducing Mandatory Rules for Cryptocurrency Exchanges! source: https://en.bitcoinsistemi.com/another-country-is-introducing-mandatory-rules-for-cryptocurrency-exchanges/

- Dec 20, 2023 5:48 pmGood News from This Country for Ripple (XRP)!Ripple noted that the Central Bank of Ireland has added the company's subsidiary, Ripple Markets Ireland Limited, to its existing VASPs. Continue Reading: Good News from This Country for Ripple (XRP)! source: https://en.bitcoinsistemi.com/good-news-from-this-country-for-ripple-xrp/