Analyst: The impact of Mt. Gox repayment on BTC is not as bad as imagined

Author: Tom Mitchelhill, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Mt. Gox is set to repay $8.5 billion worth of bitcoin to creditors next month, and analysts say that this may not have as big an impact on the price of bitcoin as many people expect.

IG Markets analyst Tony Sycamore noted that there are too many historical factors to make specific predictions about the impact of the upcoming repayment, but estimated that about half of the bitcoins - worth about $4.5 billion - may begin to enter the market in July.

Mt. Gox was a Japanese cryptocurrency exchange that collapsed after being hacked in February 2014. The exchange lost about 940,000 BTC, which was worth only $64 million at the time.

Mt. Gox recovered 141,687 BTC to return to creditors, worth $8.5 billion at press time. Payments to creditors will begin in early July.

While an influx of bitcoin may be imminent, Sycamore said he believes much of the so-called selling pressure at Mt. Gox is already reflected in current market conditions.

“The repayments have been going on for a long time,” he said.

Sycamore said: "The repayments are occurring against the backdrop of deteriorating market sentiment, technical selling and outflows from Bitcoin ETFs." He added that much of the speculative "hot money" in the crypto space has left to chase "greener pastures" in large-cap stocks such as Nvidia and Apple in the stock market.

Speaking about the broader Bitcoin price action, Sycamore said he does not believe the current sell-off will have much further to fall. He pointed to strong support from the 200-day moving average as reason for optimism in the weeks ahead.

“I suspect this may have provided a fairly good entry point for those who had been holding out for higher buy levels.”

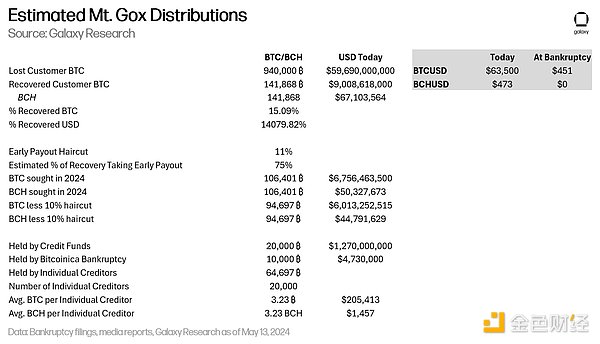

In a June 25 X post, Galaxy Digital’s head of research Alex Thorn estimated that only 65,000 of the 141,000 bitcoins actually made it to the market in their entirety — significantly reducing the expected sell-off activity.

Thorn predicted that around 75% of creditors chose to accept “early” payments, sacrificing 10% of repayments in the process, resulting in around 95,000 BTC coming to the market.

In addition, he added that the claims fund was owed 20,000 BTC and Bitcoinica BK was owed around 10,000 BTC, leaving only 65,000 BTC to go to general creditors.

Source: Galaxy Research

Mt. Gox Creditors May Hold BTC for a Long Time

In addition, Thorn explained that there are several reasons to believe that individual Mt. Gox creditors will be more "generous" than the market expects.

He noted that most creditors tend to be “long-term Bitcoin holders” and are more likely to hold Bitcoin, and stressed that many individual creditors have resisted “compelling and aggressive proposals” in their claims for years that offered U.S. dollar payments, suggesting they want their Bitcoin back, not fiat currency.

He also pointed out the impact of capital gains taxes on sellers, saying that while the original creditors received only 15% of their recovery in kind, many creditors have seen a 140-fold increase in their gains since the Bitcoin was recovered in bankruptcy proceedings.

Thorn said the potential selling pressure on Bitcoin Cash could be “much more severe” because many investors never actually bought BCH directly and only received it as a result of the Bitcoin hard fork that occurred in 2017.

Live Updates

- Jun 25, 2024 4:37 pmBitcoin Recovers Above $60K, Polkadot (DOT) Eyes $6 (Market Watch)Bitcoin bounces back above $60K but the bears might not be done yet. source: https://cryptopotato.com/bitcoin-recovers-above-60k-polkadot-dot-eyes-6-market-watch/

- Jun 25, 2024 4:35 pm싱가포르 최대 은행 애널리스트 "BTC, 하반기 횡보 예상"싱가포르 최대 은행 DBS 수석 투자 애널리스트 대릴 호(Daryl Ho)가 블록헤드와의 인터뷰에서 "비트코인은 금과 비슷한 속성을 가지고 있고, 점점 보급되고 있지만 금처럼 역사가 길지는 않다. 수익을 기대한다면 좀 더 장기적으로 접근해야 할 것"이라고 말했다. 그는 "BTC는 반감기와 금리 인하 등 유동성 자극 효과가 나타날 때까지는 빠른 상승이 나타나지 않을 것이다. 암호화폐 시장 자체도 2024년 하반기에는 트리거 부족으로 횡보할 것으로 예상된다"고 덧붙였다.

- Jun 25, 2024 4:33 pm아이리스넷, 코스모스 IBC 익스플로러 IOB스캔 출시아이리스넷(IRIS)이 공식 블로그를 통해 코스모스 IBC(인터블록체인 커뮤니케이션) 지원 60개 네트워크를 추적할 수 있는 익스플로러 IOB스캔(IOBScan)을 출시했다고 밝혔다. IOB스캔은 퍼블릭 키 관련 계정 미리보기와 API 서비스 등을 지원한다.

- Jun 25, 2024 4:33 pmOKX will carry out DORA token swap. The deposit and withdrawal functions are currently closed and will be restored after the swap is completed.According to the official announcement, according to the official plan of Dora Factory, OKX will carry out DORA token swap, the specific arrangements are as follows: DORA deposit and withdrawal functions have been closed. DORA transactions are not affected. After the swap is completed, OKX will restore DORA deposit and withdrawal functions, and will no longer support the recharge of old DORA. Please pay attention when recharging to avoid property losses.

- Jun 25, 2024 4:26 pmThe transaction volume of 6 Hong Kong virtual asset ETFs today was HK$27.7446 millionHong Kong stock market data shows that as of the close, the transaction volume of 6 Hong Kong virtual asset ETFs today was HK$27.7446 million, of which: the transaction volume of Huaxia Bitcoin ETF (3042.HK) was HK$17.44 million, and the transaction volume of Huaxia Ethereum ETF (3046.HK) was HK$1.56 million; the transaction volume of Harvest Bitcoin ETF (3439.HK) was HK$4.84 million, and the transaction volume of Harvest Ethereum ETF (3179.HK) was HK$1.1 million; the transaction volume of Bosera HashKey Bitcoin ETF (3008.HK) was HK$2.4 million, and the transaction volume of Bosera HashKey Ethereum ETF (3009.HK) was HK$404,600.

- Jun 25, 2024 4:22 pmAevo: Second Airdrop Project AZUR Token Claims Now OpenAccording to Aevo’s official post on the X platform, the second phase of the platform’s airdrop project AZUR is now open for application. Users who meet the Azuro Aevo Airdrops qualifications can receive token rewards. This airdrop is mainly aimed at Aevo pledgers and Aevo pre-market traders. Eligible wallets must have ETH on the Ethereum mainnet to complete the application.

- Jun 25, 2024 4:20 pmDWF랩스 설립자 "신규 펀드·인큐베이팅 프로그램 출시 예정"암호화폐 마켓 메이킹 업체 DWF랩스 공동설립자 안드레이 그라체프(Andrei Grachev)가 X를 통해 "시장의 등락에 일희일비할 필요 없다. 여름은 항상 암호화폐 가격이 약세를 보인 시기였으며, 현재 최선의 선택은 BUIDL(생태계 조성)에 집중하고 하락한 자산에 투자하는 것이다. 새로운 펀드와 인큐베이팅 프로그램이 곧 출시될 것"이라고 전했다.

- Jun 25, 2024 4:19 pmCosmos: Interchain aggregator IOBScan has been launched, providing on-chain tracking and account aggregation functionsAccording to official news, Cosmos launched the inter-chain aggregator IOBScan, which achieves comprehensive tracking of IBC tokens, chains, channels and relays through seamless integration of 60 IBC-supported chains. It is understood that IOBScan also has an account aggregation function, which can provide users with a bird's-eye view of all addresses associated with the same public key to simplify the complexity of multi-chain interactions; API services can facilitate users to access detailed blockchain data.

- Jun 25, 2024 3:29 pm디핀 토큰, 암호화폐 시장 침체 속에서도 뛰어난 성과 달성탈중앙화 물리적 인프라 네트워크(DePin) 토큰은 지난 24시간 동안 급등하며 전체 암호화폐 시장을 능가하는 성과를 거두었습니다. 비트코인이 58,500달러 이하로 하락한 후 디핀 토큰은 강하게 반등했습니다. 이 분야는 기술 적응력의 최첨단을 보여줄 뿐만 아니라 암호화폐가 주도하는 혁신의 다음 물결을 활용하고자 하는 투자자들에게 유망한 분야이기도 합니다. 아위브, 렌더, 아카시 네트워크가 디핀 반등을 주도하다 코인마켓캡에 따르면, 디핀 섹터는 지난 24시간 동안 7.49% 상승했습니다. 현재 총 시가총액은 258억 달러에 달합니다. 시가총액 기준 상위 10개 디핀 토큰 중 지난 24시간 동안 12.71% 상승한 아위브(AR )가 가장 높은 상승률을... source: https://kr.beincrypto.com/base-news/63341/

- Jun 25, 2024 3:16 pm스웜 마켓의 금 기반 NFT, 실물 자산 토큰화 부문 확대토큰화는 기존 자산 시장과 디지털 자산 시장을 연결하여 투자 세계를 변화시키고 있습니다. 이러한 변화의 일환으로 베를린에 본사를 둔 플랫폼인 Swarm Markets는 금으로 뒷받침되는 대체불가능 토큰(NFT)을 출시할 예정입니다. 이 제품은 블록체인 기술의 실용적이고 새로운 응용을 제공합니다. 규정 준수 보장: 스웜 마켓의 금 기반 대체 불가능한 토큰에 대한 접근 방식 스웜 마켓은 금으로 뒷받침되는 대체 불가능한 토큰을 통해 실물 자산(RWA)을 토큰화하는 데 앞장서고 있습니다. 이 방안을 통해 개인은 런던에 위치한 브링크의 금고에 안전하게 보관된 실물 금의 소유권을 나타내는 NFT를 구매할 수 있습니다. 스웜 마켓은 탈중앙화 장외거래(dOTC) 플랫폼에서... source: https://kr.beincrypto.com/base-news/63339/